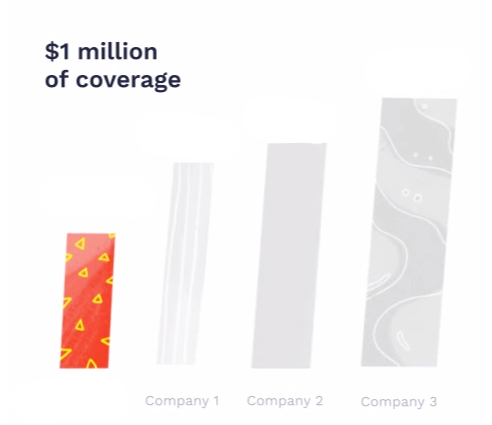

STARTING AT $1/Day

Life insurance that makes sense

For the average American, Buying life insurance can be a difficult, expensive, and time consuming process. Jon makes things easy by doing all the research and providing you with the best options.

Peace of Mind for the price of a nice dinner

Affordable coverage

More than 50% of Americans overestimate the cost of life insurance by 300%, but its not their fault! Life insurance is confusing and complicated. Jon is here to solve that by getting Americans the best policy for their situation, and it starts at as little as $30/month.

PLANNING AHEAD

Why do people get life insurance?

Life insurance works to provide financial security to your loved ones after you pass away. This is especially true if your loved ones rely solely on your income. Get yourself adequate coverage. That way, you won’t leave your loved ones helpless when the monthly bills come around.

Only recommend certified partners

You're in good hands

Jon partners with the top Insurance carriers. Only the most reputable meet our high standard of service.

Highly Rated

All our life insurance providers have hundreds of 5 star reviews.

In-Depth Review

When you contact Jon we will do an in depth review of our database to find the perfect partner for you.

Quality Matters

All of our Life Insurance partners are Top Insurance Carriers with millions of current policyholders ensuring you get a policy you can truly rely on.

How It Works

You're in good hands

Fill out the form or take our assessment and Jon will Immediately search the database of certified life insurance partners to find the perfect option for your situation.

Take assessment

Our life insurance assessment will help us recommend the right partner for you (not all life insurance works for everyone!)

Jon will find your match

Based on your answers Jon will determine if you qualify and match with one of our partners.

Get the perfect policy

Jon will connect you with a partner that he knows will be able to serve you best and get you the coverage you need!

How It Works

So, how does it work?

Fill out the form or take our assessment and Jon will automatically search his database of certified life insurance partners to find the perfect option for your situation.

Take assessment

Our life insurance assessment will help us recommend the right partner for you (not all life insurance works for everyone!)

Jon will find your match

Based on your answers Jon will determine if you qualify and match with one of our partners.

Get the perfect policy

Jon will connect you with a partner that he knows will be able to serve you best and get you the coverage you need!

INSURANCE JON

Protect those who matter

We would all do anything for our loved ones, and now Jon makes it easier than ever to get Life Insurance that protects your family financially.

When do I need life insurance?

if you’re planning on getting married, having kids, or buying a home, you should probably start to think about it. You will want to make sure that your family is provided for, and can pay off your debts after you’re gone. Getting life insurance while you are young and healthy can result in lower premiums, as you pose a significantly lower risk.

Does my age effect my cost?

Yes, your age can affect your premiums. Your insurance company is going to evaluate the risk that you pose to the company and place you in a ‘risk grouping’. Usually, the younger you are, the healthier you are, the lower the risk you pose, the lower the premiums that you have to pay. Keep in mind that age is only one factor, and the insurer will also look at things like your gender, medical history, physical condition and if you smoke.

How much do I need?

There is no one-size-fits-all answer. The amount of insurance you will need is a highly personal decision. A life insurance agent will look at your assets, debts, personal situation, financial goals and your family’s needs so they can make recommendations tailored to you. Remember, your needs might change throughout your life, so it’s a good idea to review your policy at milestone events such as getting married or having a baby.

Why do people get life insurance?

Life insurance is a way to make sure that your family and dependants don’t suffer financially when you die. Life insurance can be used to pay for a funeral, pay off debts (including your mortgage), pay for your children’s education and help your family maintain their standard of living when they no longer have you to support them.